Mutual Fund

-

5 Types of Investments That You Should Know About

It is one thing to make money to cover your expenses. It is another thing for you to make money and then invest that money back into your future. There are many ways to do…

-

Best Tax Saving Mutual Funds to Invest in India

If you’re looking for a type of mutual fund that lets you generate wealth while saving on taxes, Equity-Linked Savings Scheme (ELSS) is your best bet. This is the only type of mutual fund that…

-

How Saving and Investing Jive Together

When payday comes along, most of us take care of the bills and groceries. Some will pay off loans, whether these turn out to be home loans or car loans. Others may put money into…

-

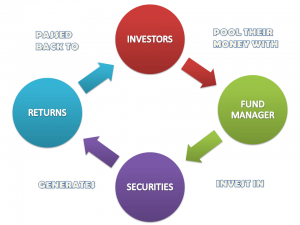

Mutual Funds

A mutual fund is a common pool of money in to which investors with common investment objective place their contribution that are to be invested in accordance with stated investment objective of the scheme. A…