At the heart of a personal savings plan is the ability to manage both income and expenditure. A basic rule of financial success is to never spend more than you earn. While this principle is fairly straightforward, reality can get a little more complex. Many people will start out with a good and practical personal budget but end up going off track thanks to unpredictable expenses.

Such an unforeseen expense could be a flat tire, plumbing repair or a sudden flight. Nonetheless, you can make unpredictable expenses more predictable and here’s how.

1. Track All Expenditure

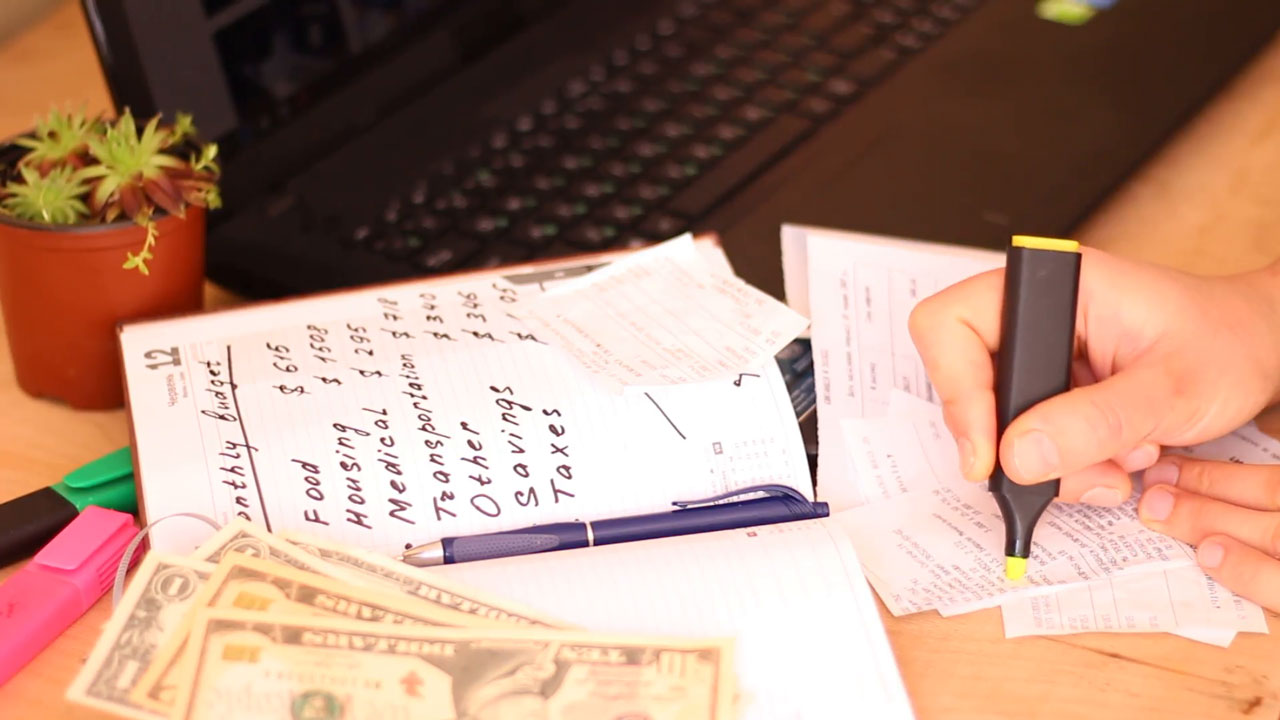

Expense management must begin with expense tracking. Write down and document every expense you incur over a period of at least six months but preferably longer (12 months should cover near all types of expenses you’ll ever incur).

Expense tracking is about identifying trends and patterns. The one thing this exercise will show you is that a number of expenses you considered unpredictable actually aren’t. They just happen to have a longer cycle and are out of mind by the time they recur. Tracking your spending will allow you to accurately identify the nature and magnitude of the truly unpredictable costs.

2. Create a Reserve Account

The information gathered from expense tracking can help you develop a realistic estimate of how much money you should set aside for ad hoc payments. Start by adding all irregular expenses over the 6 or 12-month tracking period and divide by 6 or 12 to determine the average monthly unanticipated expense.

Next, open a reserve account separate from your ordinary and emergency savings account. The reserve account should cater for unpredictable costs only including car maintenance, home repairs, emergency travel, and wedding and birthday gifts for relatives and friends.

Identifying the right amount to place in the reserve account is a continuous learning process. There’ll be new unpredictable expenses throughout your lifetime as previous ones fall away. You’ll have to adjust the amount you allocate to the reserve account to accommodate these changes.

3. Take an Insurance Cover

Whereas unpredictable expenses are often unforeseen, there’s an entire branch of science devoted to calculating and managing the unpredictable. Actuaries spend time studying historical data around risk events affecting a wide population in order to determine the likelihood and impact of a risk event affecting any one individual.

The probability is what determines the premiums you pay when you take an insurance policy. Insurance allows you to take away the surprise element of certain expenses by paying a fixed regular amount to mitigate against a specific risk. The risk in question could be a medical emergency or a car accident.

4. Resolve Root Causes

Sometimes, unpredictable expenses are a result of a deeper unresolved issue. Take car repair and maintenance as an example. The older your car, the higher and more regular the costs of repair and maintenance are likely to be. If you want to eliminate these sporadic costs, it may be time to consider replacing your current car with a newer one.

If you are always in the hospital due to an assortment of health problems, perhaps you want to find out if these illnesses are preventable. You may find that changing your diet, exercising more or moving into a less stressful job could cut your medical costs substantially.

5. Discipline

Some expenses are not so much unpredictable as they are unplanned. Your friends may approach you with an offer to go on a spontaneous trip over the weekend. It certainly sounds like a fun idea but is it necessary? Entertainment costs can be a huge financial burden if allowed to spiral out of control.

Carefully plan your vacations, leisure time and entertainment. Do not deviate from this plan no matter how right and convenient it might feel at the time. You’ll probably come across as stuck-up, boring and routine to the people around you but the financial benefits will be worth it in the long term.

Discipline also means taking advantage of all available opportunities to save money no matter how small they might seem. For instance, to prevent your phone bills becoming irregular and burdensome, use Wi-Fi calling whenever it’s available.

If you are going to achieve your long term financial goals, you must grow and stabilize your income. Just as important though is the need to stay on top of your expenses by making them more manageable and predictable.