Saving

-

8 Ways to Deal with Sudden and Unexpected Expenses

Nearly everyone has to deal with some unexpected expenses at some point. You might get hit with a bill out of nowhere. If it’s something you absolutely must pay for, that can be distressing. There…

-

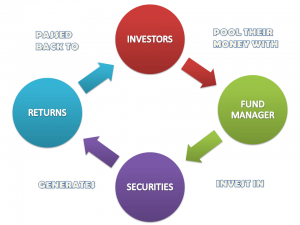

Best Tax Saving Mutual Funds to Invest in India

If you’re looking for a type of mutual fund that lets you generate wealth while saving on taxes, Equity-Linked Savings Scheme (ELSS) is your best bet. This is the only type of mutual fund that…

-

Good Financial Habits to Develop in Your Twenties

The vast majority of income earners struggle with debt and similar financial issues. While some of us keep sinking deeper into debt, others gradually manage to get out of it. Ideally, you should be in…

-

Difference of Sukanya Samriddhi vs PPF Account

Launched in the year 2015, the Sukanya Samriddhi account is one of the more applicable instruments for saving for one’s children for future needs. Apart from the Sukanya Samriddhi account, the Public Provident Fund is…